My Trading Cocoon

Net: +$404.19

Loss From Top: 0

Trades: 53

Shares Traded: 61192

Stocks Traded Today (net profit/loss):

Advanced Micro Devices (AMD): +$286.30

General Electric (GE): +$39.17

EMC Corp (EMC): +$37.91

Micron Tech (MU): +$23.48

Home Depot (HD): +$13.70

Hewlett Packard (HPQ): +$5.74

Exxon Mobil (XOM): -$0.32

Corning (GLW): -$1.81

I'm not sure if most of you readers know what it's like to be a trader in a room full of traders. At times, there's a lot of noise, swearing and banging on desks, and at other times the room is filled with silence (with the only thing we hear is CNBC and "Sqauwky" - the guy in the S&P futures pits telling us what's going on).

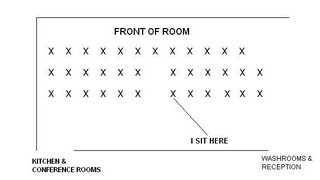

Unfortunately, I sit in a relatively high traffic area on the trading floor. Let me try to show you visually where I sit. Firstly, there are about 50 or so traders and we all sit in rows and everyone faces the front. Below is a diagram of sorts and each "X" indicates where a trader sits and please note that this is only one portion of the trading floor.

You can see that immediately to my left, there is an "alleyway" that allows traders from the first two rows to get up and leave the room. Since I sit right beside this "alleyway", there are always people getting up and walking by me. And since I sit at the back row, there are constantly people walking behind me as well.

When I was first assigned this spot on the trading floor, anytime someone would walk by, I'd look up, nod or say hi. But the longer I stayed there, the more I found that this actually distracted me a great deal. I would say that every 10 to 15 minutes, someone would walk through this allyway. Often times, I had the feeling that traders that want to exit the room simply just want to leave the room without anyone acknowledging them (i.e they need to get to the bathroom or they are hungry).

And so, I had to learn to ignore people walking by and to ignore practically everyone around me. By doing this, I could concentrate on what needed to be done and I wouldn't have to worry all the time whether I should acknowledge someone as they walk by.

Don't get me wrong - if someone came up and said "Hi", I'd gladly stop what I was doing and have a chat. But in order for me to get myself in the right state of mind, I had to setup my own trading cocoon - a kind of barrier to the surrounding environment. No - I NEEDED to set this up, especially in a hectic environment like a trading floor.

Everyday this cocoon is automatically established and it was actually a lot easier to do than I had originally thought it would be. Sometimes my trading cocoon is soo air tight that there were times the trader who sits next to me asked me something or said something to me, but I did not respond. He'd have to say it again before I realized he was talking to me!

I have a feeling that some of the other traders where I work think I'm unfriendly because I don't say "Hi" to them or even acknowledge them when they walk by. But it's not that I'm unfriendly - it's because I'm wrapped up in my cocoon! Just knock on the door and I'll let you in!

Anyways, today I just traded till lunch. Caught a nice move on AMD early in the morning and just took small winners here and there for the rest of the morning.

Also - the following stocks were added to the Hybrid system today:

Countrywide Financial Corp (CFC)

Proctor & Gamble (PG)

Labranche & Co (LAB)

No longer are there delays in filling prints and prices just seemed to move more fluidly. Too bad EMC is one of those stocks that doesn't really go anywhere for most of the day. I'll continue trading this stock and I'll share more of my thoughts later in the week.

Now if only I could effectively establish a trading cocoon within my own mind as easily as I did with my trading environment...

Good Trades

9:32AM - Advanced Micro Devices (AMD) had turned down and started falling while the Futures opened up and began to fall as well. There was some size on the bid at $25.40 and when it broke, I tried to get short 2000 shares, but I got partially for 900 shares. AMD just tanked from there and I rode it until it's downside momentum seemed to tire out. I got out as follows: 15-cent winner (100 shares), 23-cent winner (800 shares) ($199 profit before fees; In: 9:32:05AM ; Short 900 shares @ $25.40 ; Out: 9:36:04AM)

Bad Trades

None.

9 Comments:

Good job JC. Trading in the morning session did you well today.

Kudos!

By Anonymous, at October 16, 2006 6:09 p.m.

Anonymous, at October 16, 2006 6:09 p.m.

Wait, why aren't you trading from home?

By Anonymous, at October 16, 2006 6:33 p.m.

Anonymous, at October 16, 2006 6:33 p.m.

Was just wondering why you trade such thick stocks??

Is there any reason behind it??

By Anonymous, at October 16, 2006 6:42 p.m.

Anonymous, at October 16, 2006 6:42 p.m.

Loss From Top = 0! way to go!

By ryuu, at October 16, 2006 6:53 p.m.

ryuu, at October 16, 2006 6:53 p.m.

Stockroach,

Thanks! I think for the rest of this week I'm just gonna trade the mornings. I did feel a little like staying after lunch today, but I thought better of it - at least just for now...

Anon@6:33PM,

Nope - I'm not remote trading...every morning I head into the trading office...it's just the way the prop firm I work for works

Anon@6:42PM,

I mainly trade thick stocks because I can get in with bigger share size. Since I lack patience and I don't like holding on to losing trades, I'll get into these thicker stocks with a 10,000 share position, take it for 2-cents ($200 profit) in less than 1-minute. I'd rather do that than to get into a thinner stock with 500 shares, take it for 40-cents ($200 profit) in 30 minutes. Again, mainly because I don't like holding on to positions for too long.

Ryuu,

Yay! It's been a while since I had a Loss From Top = 0. Let's see if I can string together a few good trading days!

Good luck to all and happy trading!

By J.C., at October 16, 2006 8:38 p.m.

J.C., at October 16, 2006 8:38 p.m.

You will do great. Afternoon trading can be a bit more challenging at times as compared to the morning session. I look forward to seeing how your morning trading session trading unfolds.

It's just a video game with old school 8-bit graphics, nothing more ;-)

By Anonymous, at October 16, 2006 8:50 p.m.

Anonymous, at October 16, 2006 8:50 p.m.

Stockroach,

Thanks for the encouragement! I too will be interested to see how well these morning sesions go. THere are a couple of traders in our office that currently do this. We'll see - if the results are good, then I guess I'll be considered a part-time trader! (3 hours a day, 5 days a week, only a 15 hour work week! not bad!)

By J.C., at October 16, 2006 9:58 p.m.

J.C., at October 16, 2006 9:58 p.m.

I don't get it. Frankly if you can trade the am you should be able to trade the pm. No disrespect but it seems a little off.

By Anonymous, at October 16, 2006 11:53 p.m.

Anonymous, at October 16, 2006 11:53 p.m.

Anon@11:53PM,

Don't worry, none taken. I think this really depends on how you trade. For me, because I scalp, it can be very mentally exhausting and I find that my concentration and focus level is not as high as in the morning. As a result, I often find myself trading because I am either bored or I put on a trade in which I break my trading rules.

Lately (if you haven't noticed), I've been losing a ton of money in the afternoons - I start having several losers in a row and by the end of the day, I end up with way less than what I had in the mornings. On most days, I'm usually up around $300 - $600, but I'm not too sure what it is, but at the end of the day, I end up with only a few bucks.

I'm just trying to try something out for now - I just want to string together a couple of decent days. It's not fun to come home everyday knowing I lost $400 or $500 or $600 in the afternoons. We'll see - this will probably be a temporary thing.

By J.C., at October 17, 2006 12:06 a.m.

J.C., at October 17, 2006 12:06 a.m.

Post a Comment

<< Home