The "I-Don't-Care" Attitude

Net: -$19.30

Loss From Top: $373.17

Trades: 169

Shares Traded: 329576

Stocks Traded Today (net profit/loss):

AT&T (T): +$412.93

Advanced Micro Devices (AMD): +$170.59

Corning (GLW): +$103.06

Disney (DIS): +$90.16

Motorola (MOT): -$109.82

Hewlett Packard (HPQ): -$126.21

Walmart (WMT): -$164.48

Home Depot (HD): -$395.51

What a crazy day it was today.

First we had Walmart (WMT) and Home Depot (HD) report before the open, which made for some great trading in the morning. Within the first 10 minutes of trade I had made a quick $350+ net.

But then it happened. I started thinking about money again. I started thinking about how much I could make after a good start to the trading day. For some reason, everytime I start thinking about money, no matter how subtle, my trading suffers.

Even if I think about it during the weekends or before I get into the office, I somehow lose money. I don't know what's wrong with me - the more I think about the money, the more I tend to lose.

Anyways, from there it was a combination of this thinking and some very very poor timing made on my part that led to a mental breakdown.

By 10AM, I had lost everything I had made. It seemed like no matter how good a setup was or how perfectly a stock met my trading criteria, I just couldn't seem to bag a winner.

At that point, I started adopting an "I Don't Care" attitude. I found myself thinking "Ummm...this doesn't look like a good trade to get into, but since nothing else seems to be working.....ahhh I don't care....let me just get in to see what happens".

This mentality came about, not from anger, but from more of a "I give up" kind of thinking. My mind just didn't care any more and because it seemed like no matter how hard I tried to be careful and how picky I was about a trade, I ended up losing.

I even put on several trades that were the exact opposite of what I'd normally do...this was done on the basis that since previous trades that had a great setup ended up as losers, the opposite of what I think is right should be a winner.

You think this worked?

Obviously not...

I would continue to lose money until I was down almost $600 net and had a loss from top of close to $900.

I just remember sitting there for a few minutes, not believing that I did this to myself. I sat there not believing that I allowed myself to let my mind slip like that.

Just then, the markets offered an opportunity for me to get myself out of a jam - it started ripping up like crazy at around 2:30PM.

Within 30 minutes, I made it all back and more - I was up $300 net by 3PM!

Unfortunately I kept trading as though the markets were still moving, but as you can see, during the last hour of trade we didn't really move anywhere and I slowly gave back all my agains (again).

When the day was said and done, I had to catch my breath - it was a rollercoaster of a ride today. I broke my record for number of shares traded today, but big deal...I wasn't able to do anything productive with it.

All in all, there were SIX bad trades and TWO good trades.

A patient trader would have done better. A trader with a sound mind would have done better. A smarter trader would have done better. An emotionless trader would have done better. A confident trader would have done better. A trader who had the strength to not trade would have done better.

Honestly? I have to pick it up a little if I want to continue to do this. I cannot keep having these poor performances and I don't think I can keep this up for much longer...

Good Trades

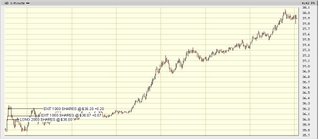

9:33:13AM - Home Depot (HD) opened and started moving up while the Futures had just opened. HD quickly made it's way to the $36 level and when it broke, I went long 2000 shares. I got out as follows: 7-cent winner (1000 shares), 20-cent winner (1000 shares) ($270 profit before fees ; Long 2000 shares @ $36.00 ; Out: 9:35:12)

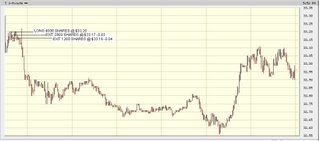

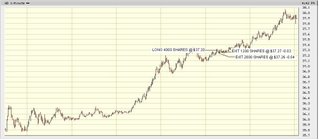

2:44:02 - AT&T (T) was ripping up and so were the Futures. I went long 4000 shares when I had an opportunity and got out as follows: 4-cent winner (900 shares), 5-cent winner (3100 shares) ($191 profit before fees ; Long 4000 shares @ $32.82 ; Out: 2:44:23)

Bad Trades

9:45:05 - AT&T (T) was up, but was at resistance while the Futures started to move down. The thought of money came into my mind and when the resistance level looked like it would break, I went long 4000 shares. All I saw was $ in my eyes, but this trade didn't work out. I got out as follows: 3-cent loser (2800 shares), 4-cent loser (1200 shares) ($132 loser before fees ; Long 4000 shares @ $33.20 ; Out: 9:45:52)

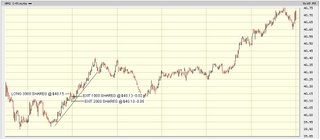

10:51:15 - Hewlett Packard (HPQ) was uptrending while the Futures were flat. The Futures popped up briefly so I went long 3000 shares. The Futures quickly popped back down and so did HPQ. I got out as follows: 2-cent loser (1000 shares), 5-cent loser (2000 shares) ($120 loser before fees ; Long 3000 shares @ $40.15 ; Out: Did not record)

11:13:51 - Home Depot (HD) looked like it was moving back up to test it's intraday high while the Futures were flat. I don't know why, but I decided to go long 4000 shares. It didn't work out. Got out as follows: 2-cent loser (2000 shares), 6-cent loser (2000 shares) ($140 loser before fees ; Long 4000 shares @ $36.15 ; Out: 11:15:52)

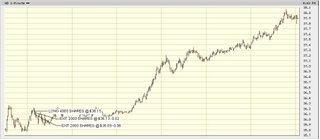

1:29:21 - Walmart (WMT) was uptrending, but flattening while the Future were flat. I didn't really care about whether this would work or not, so I went long 3000 shares. This quickly went against me, so I got out as follows: 2-cent loser (100 shares), 3-cent loser (300 shares), 4-cent loser (1900 shares), 5-cent loser (300 shares), 7-cent loser (400 shares) ($130 loser before fees ; Long 3000 shares @ $47.75 ; Out: 1:29:47)

2:18:40 - Home Depot (HD) was uptrending while the Futures were curving downwards. Decided to get long 4000 shares for no apparent reason...got out as follows: 3-cent loser (1200 shares), 4-cent loser (2800 shares) ($148 loser before fees ; Long 4000 shares @ $37.30 ; Out: Did not record)

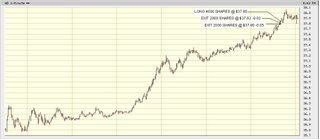

3:39:47 - Home Depot (HD) was moving up and so were the Futures. I went long 4000 shares, but just got chopped out. I got out as follows: 3-cent loser (2000 shares), 5-cent loser (2000 shares) ($160 loser before fees ; Long 4000 shares @ $37.85 ; Out: 3:40:11)

Labels: psychology, self assessment, trading

9 Comments:

I don't mean to pick on your scabs, but why do you think your good setups and stocks that meet your criteria didn't work out? Was it just a disagreeable market?

And cheer up bud, I'm sure things will pick up soon enough.

Fernando

By Anonymous, at November 14, 2006 7:42 p.m.

Anonymous, at November 14, 2006 7:42 p.m.

I try not to think in terms of dollars and cents. I pretend I am playing a video game and treat the dollars as points.

By Anonymous, at November 14, 2006 8:11 p.m.

Anonymous, at November 14, 2006 8:11 p.m.

Trading can sometimes be a tough way to make a living.

You've made a success of your trading since you began months ago so give yourself credit for that. It isn't easy.

If you are questioning your longevity trading as a scalper it may be time to step back and think about a few things.

There are many ways to make $$ consistently trading the market(s). You are currently pursuing one of them. Unfortunately you have chosen (in my opinion) one of the most difficult.

I say this because to be a successful scalper you have to have ten times (10x) the mental sharpness and focus as compared to other traders trading longer time frames. It truly can be a mentally gruelling endeavor as you well know.

You may be at the point that you need to ask yourself if you have the heart, passion and desire to continue trading as a scalper. I believe in order to be long term successful and happy doing anything you need to be doing what you love. Maybe it is the style of trading that may not fit your personality or maybe it is, only you can answer that.

So far you have shown the chops to make a success of it. It is now time to see if you have the heart and passion for it. Grinding your way to profits is a tough gig for anyone to stomach, but you have shown it can be done.

Can you make more money and be happy doing something else without the mental and emotional aggravation of trading?

These are just some things that I would personally ask myself going forward.

There is no right or wrong answer.

You have to love what you do, or your trip will be long and miserable.

You will spend most of your life working for a living so find something you truly love, it makes all the difference. If trading is it, then be the best trader you possibly can.

Look into the mirror.......... you have met the enemy.......... ;-)

By Anonymous, at November 14, 2006 8:53 p.m.

Anonymous, at November 14, 2006 8:53 p.m.

JC, I purposely repeated myself regarding love and passion for one's work.

I am trying to drive home the most important point of my post.

You know what to do.

By Anonymous, at November 14, 2006 8:59 p.m.

Anonymous, at November 14, 2006 8:59 p.m.

Fernando,

Thanks for your comments. I think my problem was that I was scared too easily and most of my trades were in the right direction...only I got chopped out and I feared that the move against me would go even further against me. Over the next little while, I'll try to work on this...

Anon@8:11PM,

Thanks for your comments. Some good advice. I should just try to make every trade the best trade I can put on, then money will follow. I've just got to get myself thinking the right way.

Stockroach,

Thank for the very inspiring comment! You're right about how scalping is way more emotionally gruelling than other types of trading - and sometimes is comes through in my post. I can't picture myself doing anything other than trading - I love doing this to death...I just wish it would reward me a little more for trying soo hard. I'll keep my head up - I've just got to keep myself balanced (emotionally, mentally, and physically). Thanks my friend - you always seem to get me to see the light and to steer me onto the right path.

I hope for some good trading to all!

By J.C., at November 14, 2006 10:11 p.m.

J.C., at November 14, 2006 10:11 p.m.

If I may ask, what is do you pay per share?

By Anonymous, at November 14, 2006 10:31 p.m.

Anonymous, at November 14, 2006 10:31 p.m.

hi JC,

I had a very similar day and I'm having similar thoughts about trading. I've kind of come to the conclusion that I love trading too much to do anything else. Even though I question myself a lot, deep down I know I can do it. So, the problem is just finding the best way to make it work. Maybe it is a different trading style or with a different firm - or even another part-time job. It is hard, but I am confident that we can both figure out a way to really make it.

It is funny because in some ways trading doesn't seem like a real job - I love it so much and my hours are shorter. On the other hand, it is SOOO MUCH work and I spend hours and hours of thinking about it. Sometimes I am exhausted from pouring so much emotion, effort and thought into it.

Good luck.

By Anonymous, at November 14, 2006 11:02 p.m.

Anonymous, at November 14, 2006 11:02 p.m.

My best decisions are usually the ones where I decide not to take a trade.

By Anonymous, at November 15, 2006 12:22 a.m.

Anonymous, at November 15, 2006 12:22 a.m.

Anon@10:31PM,

Thanks for your comments. The fees I pay are fairly low because I work at a prop firm. There are 4 main fees: execution fee (13.9 cents per trade), SEC fee ($30.70/$1 million value on sell side of trade), clearing fee (35 cents per fill + 6.5 cents/1000 shares), NASD fee (0.00025/share) and gateway fee (depends on what ECN I use).

Ugly,

Thanks for the positive comments. I think I usually feel down when things look like it's turning around, but then you get smacked in the face with a couple of not-so-good days and my frustrations just come out in my posts. I guess I shouldn't expect a turnaround overnight and I have to accept the fact that this will take longer to figure it all out. Like you said - let's both keep at it and in time, we'll both find the way.

Anon@12:22AM,

Thanks for your comments. Very true! Very true! I just have to control my emotions and thinking a little better to stop myself from trading. I will work on this.

Glenn,

Thanks for your comments. :) I guess if I look at the big picture, being down 19 bucks is way better than down $600 (which I was earlier in the day). I guess I don't mind having a bad day every now and then, but when I have 2 in a row, I often get frustrated. I just have to get myself together and see what I can do the rest of the week.

Good luck to all and happy trading!

By J.C., at November 15, 2006 7:37 a.m.

J.C., at November 15, 2006 7:37 a.m.

Post a Comment

<< Home