I Survived The Morning Shake & Bake

Net: +$500.84

Loss From Top: 0

Trades: 96

Shares Traded: 181310

Stocks Traded Today (net profit/loss):

Disney (DIS): +$496.85

Corning (GLW): +$174.52

Motorola (MOT): +$108.67

General Electric (GE): +$38.70

Advanced Micro Devices (AMD): +$15.08

Walmart (WMT): -$31.25

Home Depot (HD): -$39.28

EMC Corp (EMC): -$262.46

Woooooooo weeeeeeeeeeee! What a morning we had today!

Woooooooo weeeeeeeeeeee! What a morning we had today!There was lots of shaking and baking all morning and by the time it was done, I was in the hole by a little over $300. I literally got chopped to pieces several times over this morning and on every losing trade in which I got chopped out on, I felt the need to trade even more (to try to make back what I lost).

It wasn't until I stopped to take a break and I asked myself "Why am I trying to trade this garbage market? Haven't I learned my lesson yet? How long does it take me to recognize when to trade and when not to trade?".

It were those burning questions that had me just sitting there waiting out the morning markets...and believe me, it was hard to do, especially when you know you're in a hole....you just feel like you have to do something to get yourself out of it.

Well I'm glad I had to strength to keep from trading for the rest of the morning because in the afternoon the markets started moving somewhere and I was able to make it all back and then some.

I'm also glad I had the strength to know when to take a little break (a little before 11AM today) - I felt that my frustration level was starting to mount and all I wanted to do was to try to make back what I had lost. Every losing trade sort of fed the fire to trade more...I'm just glad I didn't fall into that trap (otherwise today's result may have been a lot different).

After taking a quick stroll around the block, I came back way more focused and I really tried hard to forget what had happened in the morning.

Perhaps if I was watching Disney (DIS) this morning, I wouldn't have had the morning I had. I missed a lot of great opportunities on it this morning (I knew DIS reported, but it slipped my mind by the time I got into the office), but I was able to catch a few swings on it this afternoon.

I'll keep my commentary short today as I have quite a few trades to review today. Three good trades and two bad ones.

Let's see how much money I can pull out of the market tomorrow!

Good Trades

10:16AM - Corning (GLW) was downtrending while the Futures were down, but flattening. GLW approached some support (big size on the bid) at $20.50. When it started breaking, I went short 3000 shares and as soon as the level broke, GLW burst downwards and so I got out as follows: 5-cent winner (2000 shares), 6-cent winner (1000 shares) ($160 profit before fees ; In: 10:16:40 ; Short 3000 shares @ $20.50 ; Out: 10:18:48)

11:09AM - Disney (DIS) had just broken resistance at $33.50 and was moving up strongly while the Futures were also moving up. When I saw an opportunity, I went long 4000 shares at $33.60 and got everything out for a 4-cent winner ($160 profit before fees ; In: 11:09:25 ; Long 4000 shares @ $33.60 ; Out: 11:11:21)

11:09AM - Disney (DIS) had just broken resistance at $33.50 and was moving up strongly while the Futures were also moving up. When I saw an opportunity, I went long 4000 shares at $33.60 and got everything out for a 4-cent winner ($160 profit before fees ; In: 11:09:25 ; Long 4000 shares @ $33.60 ; Out: 11:11:21) 1:04PM - Disney (DIS) was downtrending hard while the Futures were also downtrending. There was some support at $33.40 (relatively big size on the bid) and when it broke, I quickly went short 2000 shares. At first, DIS didn't go anywhere, but then a huge market sell order came in and I quickly put out an order to get out. I got price improved and got everything out for a 10-cent winner ($200 profit before fee ; In: 1:04:47 ; Short 2000 shares @ $33.40 ; Out: 1:05:47)

1:04PM - Disney (DIS) was downtrending hard while the Futures were also downtrending. There was some support at $33.40 (relatively big size on the bid) and when it broke, I quickly went short 2000 shares. At first, DIS didn't go anywhere, but then a huge market sell order came in and I quickly put out an order to get out. I got price improved and got everything out for a 10-cent winner ($200 profit before fee ; In: 1:04:47 ; Short 2000 shares @ $33.40 ; Out: 1:05:47)

Bad Trades

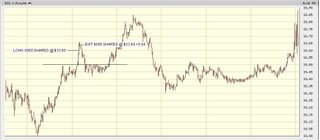

10:13AM - EMC Corp (EMC) was relatively flat while the Futures started moving down. There was huge size on the bid at $12.35 and when the Futures started tanking, I thought the big size was breaking, so I went short 10,000 shares. Well, it seemed like I was the only one who hit that level because the big size re-appeared again. I was forced out of my position as follows: 2-cent loser (5000 shares), 3-cent loser (5000 shares) ($250 loser before fees ; In: 10:13:59 ; Short 10,000 shares @ $12.35 ; Out: 10:14:33)

- Not a very smart move - the overall markets were sideways and so was EMC

- Why did I put on this trade? I dunno...maybe it was because I was getting frustrated that the markets were choppy up till this point and I really thought that this trade would be my big break

- I also felt that this morning's choppy markets resulted in a lot of games being played on the Level II (size appearing, disappearing, getting smacked then re-appearing)

10:49AM - Walmart (WMT) was downtrending while the Futures were chopping around. When I saw a level break on WMT, I went short 2000 shares @ $46.75. Well, the Futures chopped up and then there was this really awful chop up made my WMT, which had me jumping for the exits. I got out as follows: 7-cent loser (1700 shares), 9-cent loser (300 shares) ($146 loser before fees ; In: 10:49:19 ; Short 2000 shares @ $46.75 ; Out: 10:52:05)

10:49AM - Walmart (WMT) was downtrending while the Futures were chopping around. When I saw a level break on WMT, I went short 2000 shares @ $46.75. Well, the Futures chopped up and then there was this really awful chop up made my WMT, which had me jumping for the exits. I got out as follows: 7-cent loser (1700 shares), 9-cent loser (300 shares) ($146 loser before fees ; In: 10:49:19 ; Short 2000 shares @ $46.75 ; Out: 10:52:05)- This one kind of looked good to me - the only thing was that the Futures were not really moving in the same direction...I did, however realize this and I used smaller share size on this one

- I just didn't expect WMT to chop up sooo horrendously

2 Comments:

That's cool. You actually made a come back with some nice profit. Well done man.

By Anonymous, at November 09, 2006 7:59 p.m.

Anonymous, at November 09, 2006 7:59 p.m.

Gav,

Thanks for your comments! Yea - after I lost money in the morning, I found it difficult to focus and concentrate on making good trading decisions. That walk I had helped clear my mind, though I really had to be patient to wait for the opportunities to show themselves in the afternoon. However, I did find that the day was rather difficult to trade. Let's hope for some better markets tomorrow!

Good luck and hopefully you'll find some setups tomorrow!

By J.C., at November 09, 2006 8:14 p.m.

J.C., at November 09, 2006 8:14 p.m.

Post a Comment

<< Home