Stuck Between A Rock And A Hard Place

Net: +$658.33

Loss From Top: 0

Trades: 94

Shares Traded: 159200

Stocks Traded Today (net profit/loss):

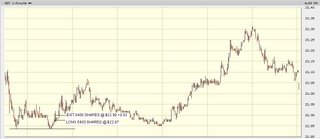

Motorola (MOT): +$356.17

Advanced Micro Devices (AMD): +$189.28

AT&T (T): +$156.60

Walmart (WMT): +$62.69

Micron Tech (MU): +$32.66

Exxon Mobil (XOM): -$2.66

Citigroup (C): -$26.36

Home Depot (HD): -$110.05

It felt good to get back on the trading floor after a week of vacation. In fact, I couldn't sleep at all last night...all I could think about was trading!

Anyways, my mind was fresh and alert and I was careful in not making too many mistakes. I stayed for a little while after lunch (I had intentions on staying the whole day), but by 2PM, I could already feel myself becoming mentally fatigued and I decided to leave after 2:30PM (before I made any mistakes!).

I still feel as though I'm on Las Vegas time and over the weekend I had a tough time trying to re-adjust.

Anyways, before I left, I had a brief discussion with one of the other traders. I mentioned to this other trader that I wished I was pulling in profits like some of the other traders in the office (who can routinely pull in $2000 - $10000 in a single day).

This other trader pointed out that those who are making a killing put on huge positions (20,000 or 50,000 share positions) and that their profits fluctuate quite a bit - one day they'll be up big, another day they'll be down big. These guys also don't mind holding on to severe losers and often times the stock does come back for them.

The other type of traders that were making good money were the ones who had the patience and often held onto positions for a long time, capturing a good portion of moves made by stocks (I'm talking about taking 50-cent or maybe even 100-cent winners). These kind of traders can easily hold on to positions for hours at a time.

But here's my dilemma...

Those who follow my blog daily know that I don't have patience and I feel extremely uncomfortable holding anything for more than 10 minutes (believe me, I'm really trying to work on this).

Those that follow my blog also know that I'm a fairly conservative person when it comes to trading and I tend to be risk-averse when it comes to putting on big positions. When I decide on putting on a position, I usually want to be protected if the stock goes against me (i.e. I adjust my position size depending on how easily I can exit my position should it go against me).

I am starting to believe that in order to up my profits, I'll have to do one of those two things (increase my share size, thus increasing my risk - or increase my patience and hold positions longer, thus also increasing my risk).

On my way home, I was thinking about this and I thought that my situation was like being stuck between a rock and a hard place - on one side was taking more risks, on the other side was having more patience.

Both of these things are hard to come by (for me anyways). I'd like to take more risks...but whenever I do, I start getting punished and end up losing a lot (I can't even believe that before the summer I was talking about putting on 20,000 and 30,000 share positions!).

I'd also like to be more patient and I believe I've made good strides in becoming more patient, but I've still a long way to go. I'm stuck with taking 5-cent winners here, 10-cent winner there when I could be taking 20-cent winner here and 30 cent winners there.

What I'll have to do in the next little while is to see if I can bump up my risk and bump up my patience if I truly want to become the trader I want to be. The next little while should be interesting indeed!

Anyways, 3 good trades versus no bad trades.

One more day and October is done...

Good Trades

10:32AM - Motorola (MOT) looked like it caught some support while the Futures were uptrending slightly. There was some good support on the bid at $22.84 and when the Futures popped up, I went long 10,000 shares at $22.85. Motorola seemed reluctant to go up, so I started exiting my position. I got out as follows: 1-cent winner (5000 shares), 2-cent winner (5000 shares) ($150 profit before fees ; In: 10:32:58AM ; Long 10,000 shares @ $22.85 ; Out: 10:35:33AM)

10:36AM - Motorola (MOT) looked like it was moving up off support while the Futures were moving up. After I got out of the previous trade (see the 10:32AM trade), MOT kept going up, so I tried to get long 10,000 shares again, but got partially filled for 5400 shares. I got everything out for a 3-cent winner a few seconds later ($162 profit before fees ; In: 10:36:54AM ; Long 5400 shares @ $22.87 ; Out: 10:37:08AM)

2:17PM - Walmart (WMT) was uptrending and so were the Futures. There was some significant resistance at the $49.60 level and when it broke, I got long 3000 shares. WMT just exploded up and I was a little too impatient and took everything for a 5-cent winner ($150 profit before fees ; In: 2:17:16PM ; Long 3000 shares @ $49.60 ; Out: 2:18:28PM)

Bad Trades

None

6 Comments:

As a person who has never had much patience, who knows it and realizes that it is a fault, I think you should try other trading strategies to fit your personality...like trading futures or indexes/indices.

Trying to change yourself is really NOT-EASY and not smart, you should adjust what you do. I have much experience trying and pass this along. Squeezing a round peg into a square hole is not a good idea.

There are many good blogs on trading futures, good luck.

By Anonymous, at October 30, 2006 6:52 p.m.

Anonymous, at October 30, 2006 6:52 p.m.

Keep doing what continues to work for you.

If you would like to go for a larger move try it with a smaller size that makes you feel comfortable. Once you have found comfort with this more patient trade, add a little larger size until it makes you a little uncomfortable. You will soon find what level of patience and size works for you.

You gotta walk before you run.

Vegas is one of my favorite places to visit. Glad to here you are back in the saddle.

By Anonymous, at October 30, 2006 7:18 p.m.

Anonymous, at October 30, 2006 7:18 p.m.

JC,

Great blog you got going. If I could add my two cents, I would say that increasing lot sizes will probably exacerbate any problems you have right now. Increasing lot sizes before you are ready tends to make you way too emotional. There are three ways to improve the bottom line.

1. Increase Lot size

2. Increase Win Pct.

3. Increase Expectancy

I would start at #3. My suggestion, which has helped me with a similar situation is to try and squeeze more out of your winning trades. The way I tackled this was to sell 1/3 to 2/3 of a position fairly quickly at first and try to follow the rest with a stop. Once you are comfortable, start reducing how much you take off the plate initially. An example would be to take 8K shares of a 10K lot for your typical win, and raise your stop aggressively on the rest. Good Luck, and keep up the good work.

DT

By Anonymous, at October 30, 2006 8:42 p.m.

Anonymous, at October 30, 2006 8:42 p.m.

Sorry for the late reply...don't know why Blogger isn't emailing me about new comments...oh well - what else is new...

Anon@6:52PM,

Thanks for your comments. Trading futures have definitely crossed my mind on more than once and it does seem interesting. I currently have entitlements to trade the ES...I have been exploring this idea lately - I'll start doing some research on this...

Stockroach,

As always, thanks for your comments! As I write this comment out right now, a thought just occurred to me...it seems like everytime I start having some sort of consistency going, I start changing my trading strategy to try to make more. What ends up happening is is that I begin to lose money (from all the changes I start making), which leads me to frustration, which leads me to re-vamp my trading plan all over again. I think you've got the right idea - I should just keep doing what continues to work for me. Perhaps once I've proven some consistency, then I can start thinking about how to make more. Thanks for turning on that light bulb in my head!

Downtowntrader,

Thanks for the compliments! Some great advice - I can definitely do something about point #3. I'll try working on that - hopefully with time I'll get comfortable selling half my position for a typical win (and holding the other half for a great winner), then eventually just selling 1/4 for a typical win (and the remaining 3/4 for a great winner), to eventually holding the entire position for a great winner. Only time will tell whether I can make this work.

I wish all of you good trading!

By J.C., at October 30, 2006 9:47 p.m.

J.C., at October 30, 2006 9:47 p.m.

Have you read "Reminiscences of a Stock Operator"? There are quite a few useful lessons there about trading, and while it is in the 1900's it is still relevant today!

By Anonymous, at October 31, 2006 11:49 a.m.

Anonymous, at October 31, 2006 11:49 a.m.

Anon@11:49AM,

Definitely one of my favorite books! Perhaps it's a good idea to read it again every once in a while just to be reminded of the lessons that are contained within! In fact, that's a very good idea - I haven't read any trading books for a few months now, so reading ROASO again sounds like the perfect idea!

Happy trading!

By J.C., at October 31, 2006 8:07 p.m.

J.C., at October 31, 2006 8:07 p.m.

Post a Comment

<< Home