AMD Keeps Churning Out Money!

Net: +$542.73

Loss From Top: $6.00

Trades: 71

Shares Traded: 93400

Stocks Traded Today (net profit/loss):

Advanced Micro Devices (AMD): +$563.74

AT&T (T): +$20.79

Home Depot (HD): +$17.07

Exxon Mobil (XOM): +$13.18

Corning (GLW): +$10.58

Motorola (MOT): -$20.43

General Electric (GE): -$62.20

Ok - this morning I woke up in a much better mood and I actually felt like I was alive today.

And look at AMD! This stock has just been tanking real hard the last two days and has been a very good short (though I lost some big money on it yesterday because I was trying to get long on it!).

I mentioned in a previous post that AMD had been really making some money for me (well, except for yesterday when I didn't have a clue as to what I was doing) and today was no different.

It's kind of weird to see that the stocks that make me money keeps rotating...a couple of months ago Citigroup (C) was my big money maker, but then I kept losing money on it, but then Walmart became my money maker...recently I haven't been able to make a dime on it, but here comes AMD to the rescue. I don't know if others have the same experience or not...Oh well, I'll just keep trading AMD as long as it's making money available for the taking.

Anyways, I tried dabbling in some of the other stocks today, but none of them seemed to offer as many opportunities as AMD, so I made it my focus stock for today. All day I just scalped it here and there.

As the morning rolled along, I began slowly reducing my share size to protect the profits I made and after lunch was said and done, I was out of the office by 12:30PM.

This week I got to see the Hybrid market in full swing - however I still haven't really traded the stocks involved. I tried trading some EMC Corp (EMC), but I find that this stock moves a little too slowly for me and as a result, I find very few opportunities on this stock.

I traded a bit of AT&T (T) today (it's also Hybrid), but I didn't not really focus on it enough to get a sense of what kind of impact Hybrid will have on my trading.

No doubt that next week a lot more stocks will be going Hybrid.

Below is a list of stocks going Hybrid on Monday (Oct 23):

ISHARES RUSSELL 1000 GROWTH (IWF)

MIRANT CORP (MIR)

FAMILY DOLLAR STORES (FDO)

AVIS BUDGET GROUP INC (CAR)

DUKE ENERGY CORP (DUK)

And below is a list of stocks going Hybrid on Tuesday (Oct 24):

GOODRICH PETROLEUM CORP (GDP)

CORNING INC (GLW)

INTERPOOL INC (IPX)

MODINE MANUFACTURING CO (MOD)

U.S. SHIPPING PARTNERS L.P. (USS)

WINDSTREAM CORP (WIN)

The interesting one for me will be Corning (GLW), which is going Hybrid Tueday.

I'll be away for the better part of next week because I'll be on vacation and I'll return on Friday. And I think I need it too - I need a bit of a vacation to get my mind off things. Hopefully I'll come back all refreshed and ready to get my trading back on track.

In the meantime, I wish all of you good trading next week!

Good Trades

9:48AM - Advanced Micro Devices (AMD) was downtrending and the Futures were also moving down. AMD reached some support in the form of size on the bid at $20.90. Then suddenly the Futures started tanking real hard and size was about to break so I went short 2000 shares. At first AMD didn't really move, so I got half my position out for a 1-cent winner. But then the Futures tanked really really hard and AMD went tumbling as well. I got 500 shares out for a 15-cent winner (and held 500 shares, but felt like it could still go down again, so I went short another 500 shares (I was short 1000 shares total). AMD seemed to sputter along, so I got out everything. I got out as follows: 1-cent winner (1000 shares), 2-cent winner (500 shares), 15-cent winner (500 shares), 16-cent winner (500 shares) ($175 profit before fees ; In:9:48:42AM ; Short 2000 shares @ $20.90, short 500 shares @ $20.75 ; Out: 9:49:33AM)

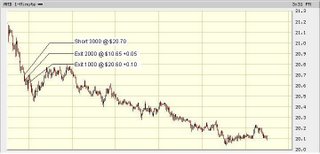

9:53AM - AMD was downtrending and so were the Futures. The Futures suddenly tanked really hard again, so I went short 3000 shares at $20.70. AMD followed suit and I got 2000 shares out and held the rest. Then suddenly I saw a big sell order come in, so I exited my last 1000 shares (it was price improved). I got out as follows: 5-cent winner (2000 shares), 10-cent winner (1000 shares) ($200 profit before fees ; In: 9:53:09AM ; Short 3000 shares @ $20.70 ; Out: 9:55:03AM)

Bad Trades

None.

14 Comments:

Hi JC,

Nice to see you had a profitable day!

With more and more NYSE stocks going to hybrid, do you think the NYSE will behave more and more like NASDAQ exchange?

Have a great weekend!

By Anonymous, at October 20, 2006 5:55 p.m.

Anonymous, at October 20, 2006 5:55 p.m.

Another great day and home early too. Congrats JC!

Enjoy your holiday, and I'm sure we're all looking forward to see more like this.

By Anonymous, at October 20, 2006 7:22 p.m.

Anonymous, at October 20, 2006 7:22 p.m.

That's a good result man. Enjoy your vacation.

Coincidentally, I am going away for vacation for a week as well. :)

By Anonymous, at October 20, 2006 9:24 p.m.

Anonymous, at October 20, 2006 9:24 p.m.

Anon@5:55PM,

Thanks for your comments! With the Hybrid coming in, it's at least one step closer to becoming more like NASDAQ. For sure the execution will be more like NASDAQ, but as for the movements in price - that has yet to be seen. I guess we'll all have to give it more time to see how everything turns out...

Tyro,

Thanks for your comments. It's nice to get away from the madness that is the markets every once in a while. And keep those great posts at your site coming! You don't know how much it helps all of us! Best of luck to you next week!

Gav,

Hey Gav! Is it another trip over to Taiwan? Well, wherever you are going, have a great and safe trip. For me, I'm heading for Vegas for a few days (no, I'm not gambling - just to see some of the lights) and a quick side-trip to the Grand Canyon - it'll be nice to get away from the crummy weather we've been having in Toronto...

Have a great weekend everyone!

By J.C., at October 20, 2006 9:46 p.m.

J.C., at October 20, 2006 9:46 p.m.

Nice comeback from yesterday's debacle.

Enjoy the trip. Upon your return you will yield some great returns. A vacation will do that sometimes.

Cheers!

By Anonymous, at October 21, 2006 9:17 a.m.

Anonymous, at October 21, 2006 9:17 a.m.

J.C.,

with regards to my last post, all I can say is "d'oh". That rarely happens with sites I visit and it didn't even occur to me to hit refresh. Anyway, good luck with your vacation.

By Anonymous, at October 21, 2006 2:40 p.m.

Anonymous, at October 21, 2006 2:40 p.m.

Hey JC,

As a new trader, i was wondering how long it took you to become more consistent, and how much money did you lose within that time. I am in my 3rd month, and am still losing. But I know quitting is not an option to me, but my mind has not all been there lately. Gotta focus more.

By Anonymous, at October 21, 2006 3:56 p.m.

Anonymous, at October 21, 2006 3:56 p.m.

Hi, JC,

I enjoy reading your blogs. I'm also a trader in Toronto.

One question. What do you mean exactly by "gross" and "net"? Where does commission and your firm's cut go?

Thanks.

Z

By wincity, at October 21, 2006 5:27 p.m.

wincity, at October 21, 2006 5:27 p.m.

JC,

From your chart, you have a good trend following strategy in place which have great potential for you to increase your profit. A good vacation can do the trick.

Enjoy your trip!

Zbs

By Anonymous, at October 22, 2006 12:50 a.m.

Anonymous, at October 22, 2006 12:50 a.m.

Stockroach,

Thanks for your comments. I am hoping that this trip will be THE turning point needed in my trading...I've been stuck in neutral for too long and I feel like I'm running out of fuel. Good luck to you next week!

Ferndando,

Hehe - don't worry - sometimes it happens to me too! Here's to some good trading by all of you next week!

Anon@3:56AM,

Thanks for your comments. Consistency is still something I have yet to achieve - everytime I think I've got my trading down pat, something changes and I find myself having to adjust and change things again. At where I work, I was a trainee for 6 months and all my full-time stats are on the sidebar. If you count my months as a trainee, my worst month was -$162.53 (which was my very first month as a trainee), my 2nd worst month was +$47.09 (which was my 3rd month as a trainee). Keep in mind that trading costs for me are very low (which is why they get a cut of what I make) and that these results are because of the type of person I am (if I see a loser, I just get out). That being said, I've seen some trainees at where I work that were negative for many months in a row before they were able to figure it all out and when they did figure it out, they became very successful! Just keep working to find out what strategy works best for you and I hope you can learn from the mistakes I make through this blog. I wish you the best of luck!

Wincity,

Thanks for the compliments! My gross is basically the difference between what I bought for and what I sold for. For example, if I went long 1000 shares and got out for a 1-cent winner, then my gross will be +$10. The "net" is what I'm left with after they take away SEC fees, NASD fees, clearing fees (charged by the company that clears our trades - in our case, it's Morgan Stanley), execution fees (14.5 cents per trade), and ECN fees (varies depending on what I use). So, now I'm left with a "net" profit (after all fees) - it is from the "net" that my company will take a percentage of. Thus, at the end of the month, they add up how much I made (net), then the take a percentage of it and I keep the rest.

ZBS,

Thanks for your comments. I hope that soon I'll be turning out some numbers similar to you. I've just got to hold some of my positions a little longer. I wish you good trading next week!

Hope that answers all your questions

By J.C., at October 22, 2006 7:24 a.m.

J.C., at October 22, 2006 7:24 a.m.

Thanks, JC. I just realized that you pay very low fees. I pay half a cent per share. I wonder what broker you use.

Also do you know if there's a Canadian broker who offers API access to their system and do RRSP accounts? I use Interactive Brokers. They offer different APIs but they don't do registered accounts.

By wincity, at October 22, 2006 10:31 a.m.

wincity, at October 22, 2006 10:31 a.m.

Wincity,

Thanks for your comments. I am currently employed with a prop firm (I trade their capital) and hence the fees to trade are much lower - and at the end I split profits with them.

I'm not really too familiar with the various brokers out there and so unfortunately I cannot offer any suggestions.

By J.C., at October 22, 2006 4:54 p.m.

J.C., at October 22, 2006 4:54 p.m.

Great trades today my man. Have a good vacation.

By Anonymous, at October 22, 2006 10:35 p.m.

Anonymous, at October 22, 2006 10:35 p.m.

Anon@10:35PM,

Thanks for your comments and we'll see you all back here again on Friday! Good trading to you!

By J.C., at October 23, 2006 8:24 a.m.

J.C., at October 23, 2006 8:24 a.m.

Post a Comment

<< Home