The Cage Rattler

Net: +$298.70

Loss From Top: $206.25

Trades: 76

Shares Traded: 191602

Stocks Traded Today (net profit/loss):

Motorola (MOT): +$326.43

General Electric (GE): +$72.85

Home Depot (HD): +$29.04

AT&T (T): +$22.99

Walmart (WMT): +$14.98

Advanced Micro Devices (AMD): -$23.24

Exxon Mobil (XOM): -$144.35

It never seems to end. Just when you thought you've identified what might be going wrong with your trading, something else pops up. Once you've figured it all out, a problem from your past re-appears.

It just seems so hard to keep everything balanced and everything in tune. I'll have it all figured out hopefully sooner rather than later.

The morning went great for me (as usual) and coming up to 11AM, I was up over $500 net.

But then, it happened.

A cage rattler.

I may have called it something differently in previous posts and it's something I know I have to work on. So what is it?

It's kind of like being told that someone close to you just passed away and you were told to continue on trading. Some people would be able to do it - but most would find it difficult to concentrate. In short, a cage rattler is something that trips you up so that you have difficulty focusing at the task at hand.

My cage rattler happened on a bad trade on Exxon Mobil (XOM) (OK, this cage rattler is not as extreme as the example I gave, but I feel it is totally applicable).

This bad trade caught me off guard and I lost focus. I knew I shouldn't have traded the rest of the morning, but that bad trade really rattled my cage and I don't know why I continued to trade.

Thirty minutes and four bad trades later, I had lost close to $600 and I found myself negative for the day (Hmmmmm....this seems to be a recurring story for me).

And it was not as if I was really upset at the bad trade on Exxon. It was more because it was totally unexpected.

Let me explain.

I knew going into the Exxon trade that things were going sideways and so I put on a small trade with the hopes of making a few cents.

On every trade I put on, I am fully prepared to lose 1 or 2 cents should the trade go against me. Sure I may also occasionally have to take a 3 or 4 cent loser if prices really started going against me. But if I have to take a loser for 5-cents or more, it means that the trade just got away from me and I couldn't get out.

I wasn't expecting much from the Exxon trade. But what I didn't expect was for it to go against me THAT much (see bad trades at 10:58AM).

I knew I had a pretty good morning going into this trade and had I just lost 1 or 2 cents on the Exxon trade, I would have been okay. But for whatever reason, that bad trade really broke my rhythm and tripped me up.

And it wasn't as if I lost a lot on that bad Exxon trade (I lost $138 before fees on it) - it was just something in my brain that felt it was unacceptable. Perhaps it was a need to try to get back into my trading rhythm or a need to try to make back what I lost. I dunno.

After I lost that $600 and found myself in negative territory, I told myself to stop, shake it off, and wait for new opportunities. I looked at the situation and scolded myself for trying to trade the completely flat morning.

So I waited until the FOMC meeting minutes were released and I was lucky to catch a late day trade on Motorola (MOT), which was basically my entire day.

There were 3 bad trades and 2 good trades.

I have to work harder to ignore the effects that individual trades may have on me and I just have to finish a trade, let it go, and move on. I'm just glad I'm keeping my emotions more in check lately...now I've got to work on my thinking...

I'm also going to stay away from Exxon Mobil (XOM) for a long while. Ever since it went Hybrid, this stock just scares the bejeezes out of me, with all it's really wicked chops. I just simply cannot handle the 10 and 15 cent quick chops that this stock now exhibits.

Good Trades

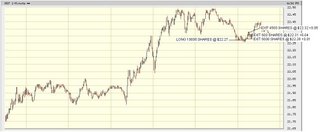

1:10:56PM - Motorola (MOT) was uptrending while the Futures were moving up very slowly. MOT was re-testing it's intraday high at $22.30 and when it broke, I went long 4000 shares. I got everything out for a 4-cent winner ($160 profit before fees ; Long 4000 shares @ $22.30 ; Out: 1:12:28PM)

3:09:07 - Motorola (MOT) was downtrending while the Futures were moving up. MOT looked like it reached support and there was huge sizes on the bid at $22.26 and $22.25 (both had 1000+ size on the bid). I went long 10,000 shares @ $22.27 and patiently held it. I got out as follows: 1-cent winner (5000 shares), 4-cent winner (500 shares), 5-cent winner (4500 shares) ($295 profit before fees ; Long 10,000 shares @ $22.27 ; Out: 3:15:48PM)

Bad Trades

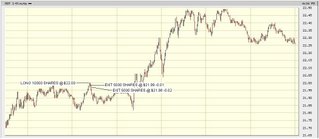

10:58:19 - Exxon Mobil (XOM) was moving up while the Futures were flat. This was the cage rattler. XOM reached some resistance at $74.80 (big size on the offer) and when it broke, I went long 2000 shares. As soon as I got in, I was looking at a bad loser and I didn't expect XOM to chop sooo severely sooo quickly and I got out as follows: 3-cent loser (200 shares), 6-cent loser (1000 shares), 9-cent loser (800 shares) ($138 loser before fees ; Long 2000 shares @ $74.80 ; Out: 10:58:48)

11:24:05 - Motorola (MOT) was moving up while the Futures were flat. MOT reached resistance at the $22.00 level and I just jumped the gun a little too soon and hit the $22.00 level with 10,000 shares. The level didn't break and started heading down. I got out as follows: 1-cent loser (5000 shares), 2-cent loser (5000 shares) ($150 loser before fees ; Long 10,000 shares @ $22.00 ; Out: 11:25:32)

11:35:45AM - Advanced Micro Devices (AMD) had just bounced after hitting intraday lows while the Futures were flat. I went long 4000 shares at $21.50. Just got chopped out and I got out everything out for a 4-cent loser ($160 loser before fees ; Long 4000 shares @ $21.50 ; Out: 11:37:07AM)

Labels: psychology, trading

5 Comments:

You mentioned this in your post tonight....

I have to work harder to ignore the effects that individual trades may have on me and I just have to finish a trade, let it go, and move on. I'm just glad I'm keeping my emotions more in check lately...now I've got to work on my thinking...

You are correct. Your acccount, losses/wins and the market have no memory. They don't have any idea what you did prior to your next trade. Every trade is a fresh start.

At least you were able to make a good recovery, but you don't want to make a habit of it because you know it eventually catches you. The mental and emotional price is dear.

You are who you think you are.

Make a fresh start!

By Anonymous, at November 15, 2006 8:10 p.m.

Anonymous, at November 15, 2006 8:10 p.m.

Stockroach,

Thanks for your comments. I definitely need some way of clearing my mind and starting fresh with each and every trade. On days where I lose a ton of money are usually the days I just couldn't let go of the previous trades. I'll strive to get that "freshness" with each and every trade!

Good luck to you and your trading!

By J.C., at November 15, 2006 8:57 p.m.

J.C., at November 15, 2006 8:57 p.m.

Hi JC,

Are there other stocks which went hybrid acting like XOM?

Do you think the overall effect of hybrid will be more choppiness?

Thank you.

I'm also going to stay away from Exxon Mobil (XOM) for a long while. Ever since it went Hybrid, this stock just scares the bejeezes out of me, with all it's really wicked chops. I just simply cannot handle the 10 and 15 cent quick chops that this stock now exhibits.

By Anonymous, at November 15, 2006 9:24 p.m.

Anonymous, at November 15, 2006 9:24 p.m.

"It never seems to end. Just when you thought you've identified what might be going wrong with your trading, something else pops up. Once you've figured it all out, a problem from your past re-appears."

^No doubt. I fully agree with that. Happens to me a lot. After I identify a problem in my trading psychology, I THEN over-think it ... causing yet another problem: a clenched fist under running water catches less water.

I have been learning to accept some flaws. That has allowed me to trade flawed, yet profitable and sane.

By Anonymous, at November 15, 2006 9:30 p.m.

Anonymous, at November 15, 2006 9:30 p.m.

Anon@9:24PM,

Thanks for your comments. The only stocks that I trade often that are Hybrid are AT&T (T) and Corning (GLW). I find that with AT&T (T), there is a lot more jiggle, but if you are patient enough, it eventually goes your way. As for GLW, I find that since it has gone Hybrid, it doesn't move around as much and spends most of the day stuck in a range. Of course, XOM is probably one of the extremes since it's related to oil and it's a fairly expensive stock. From what I've observed so far, I would say that yes, there seems to be a little more chop and movements will tend to be more back and forth within an overall trend. Hope it helps!

Mousefinger,

Thanks for your comments. Very true. It's like chasing my tail forever and ever. One of my first tasks will be to first work on those flaws that can be fixed simply by having the right mindset and I will have to admit that some flaws may be unfixable. I keep working at it!

Happy trading all!

By J.C., at November 15, 2006 10:07 p.m.

J.C., at November 15, 2006 10:07 p.m.

Post a Comment

<< Home