My Trading Journal Goes Into Retirement

Unfortunately, there are very few traders at the office that use one (in fact, I wouldn't be surprised if I was the ONLY one that uses a trading journal).

Every morning, every afternoon, and every evening I have written something in it.

It's pages are pretty much filled up, it's pages are all folded, it's cover partially ripped, and countless liquids have been spilled on it's pages (coffee is the #1 liquid).

My trade journal and I have been through a lot together and many of the lessons I've learned are contained within. This is actually my 2nd trading journal since I started at my prop firm (the first one had fewer pages and lasted me only 4 months).

Here's what it looks like (click on any of the images to enlarge):

And as you can see, most of it's pages are all folded up from me trying to cram it into my bag every day.

The very first entry was dated "Thursday September 1, 2005", which means this journal has been with me for one year and three months. On that very first entry I had a gross of +$269.90, a net of +$238.86 and I only made 21 trades!

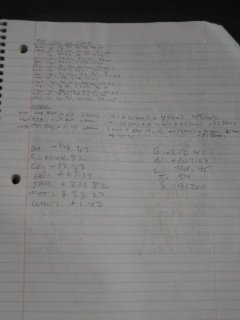

There were some days in which I wrote a lot, and other days when I hardly wrote anything at all. Here's a sample of a day in which a lot was written.

There were some days in which I wrote a lot, and other days when I hardly wrote anything at all. Here's a sample of a day in which a lot was written. A few months after I had started using this particular trade journal, I decided to fashion a back pocket that would allow me to store documents such as my trading rules and strategies. I used staples and tape and every day this back pocket would somehow scratch me from some of the deformed staples protruding from the back.

A few months after I had started using this particular trade journal, I decided to fashion a back pocket that would allow me to store documents such as my trading rules and strategies. I used staples and tape and every day this back pocket would somehow scratch me from some of the deformed staples protruding from the back. I used to write a lot in my journal, especially near the beginning of my career. In fact, I used to write down EVERY SINGLE trade in my trading journal. By the end of the day, my hands would be all cramped up (both from all the writing and all the button pushing).

I used to write a lot in my journal, especially near the beginning of my career. In fact, I used to write down EVERY SINGLE trade in my trading journal. By the end of the day, my hands would be all cramped up (both from all the writing and all the button pushing).As the months went by, I found I wasn't using a lot of the information I was writing and so my trading journal sort of evolved. Here are some of my earlier entries

I then started paring down what I wrote down because I found that a lot of it was just a waste of ink. Here are some entries from the middle of my journal

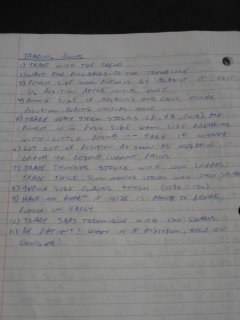

And finally here are what some of my more current journal entries look like. As you can see, it's a lot less writing - mainly because I didn't need as much information and possibly because of laziness :)

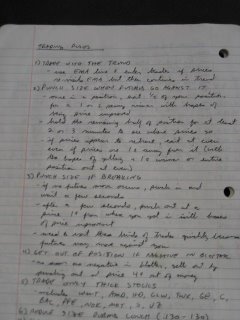

For the first few months of my trading journal's life, I wrote down my trading rules and I made it a habit of reviewing them every month. I would remove and add things to my rules and I would write them down in my trading journal. I now have an electronic version on my word processor at home and I *try* to review it monthly. Here are some of my "Trading Rules" entries from my trading journal

Also of importance were the lessons I learned on my bad days. I put notes at the bottom of my entries, whether it was something I learned, something I needed to avoid, or some kind of behaviour I needed to be aware of.

I recently bought a new notebook that is smaller and more compact that this one and will become my new trading journal.

In the meantime, I wish my trading journal a happy retirement! You've served me well and we've been through a lot together. I only wish I can learn as much from the new trading journal as you have taught me!

Labels: trade journal, trading