My Trading Journal Goes Into Retirement

Unfortunately, there are very few traders at the office that use one (in fact, I wouldn't be surprised if I was the ONLY one that uses a trading journal).

Every morning, every afternoon, and every evening I have written something in it.

It's pages are pretty much filled up, it's pages are all folded, it's cover partially ripped, and countless liquids have been spilled on it's pages (coffee is the #1 liquid).

My trade journal and I have been through a lot together and many of the lessons I've learned are contained within. This is actually my 2nd trading journal since I started at my prop firm (the first one had fewer pages and lasted me only 4 months).

Here's what it looks like (click on any of the images to enlarge):

And as you can see, most of it's pages are all folded up from me trying to cram it into my bag every day.

The very first entry was dated "Thursday September 1, 2005", which means this journal has been with me for one year and three months. On that very first entry I had a gross of +$269.90, a net of +$238.86 and I only made 21 trades!

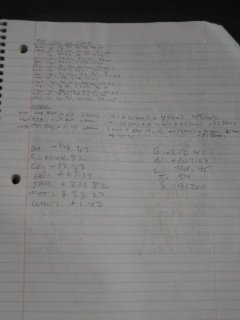

There were some days in which I wrote a lot, and other days when I hardly wrote anything at all. Here's a sample of a day in which a lot was written.

There were some days in which I wrote a lot, and other days when I hardly wrote anything at all. Here's a sample of a day in which a lot was written. A few months after I had started using this particular trade journal, I decided to fashion a back pocket that would allow me to store documents such as my trading rules and strategies. I used staples and tape and every day this back pocket would somehow scratch me from some of the deformed staples protruding from the back.

A few months after I had started using this particular trade journal, I decided to fashion a back pocket that would allow me to store documents such as my trading rules and strategies. I used staples and tape and every day this back pocket would somehow scratch me from some of the deformed staples protruding from the back. I used to write a lot in my journal, especially near the beginning of my career. In fact, I used to write down EVERY SINGLE trade in my trading journal. By the end of the day, my hands would be all cramped up (both from all the writing and all the button pushing).

I used to write a lot in my journal, especially near the beginning of my career. In fact, I used to write down EVERY SINGLE trade in my trading journal. By the end of the day, my hands would be all cramped up (both from all the writing and all the button pushing).As the months went by, I found I wasn't using a lot of the information I was writing and so my trading journal sort of evolved. Here are some of my earlier entries

I then started paring down what I wrote down because I found that a lot of it was just a waste of ink. Here are some entries from the middle of my journal

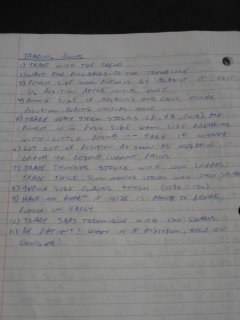

And finally here are what some of my more current journal entries look like. As you can see, it's a lot less writing - mainly because I didn't need as much information and possibly because of laziness :)

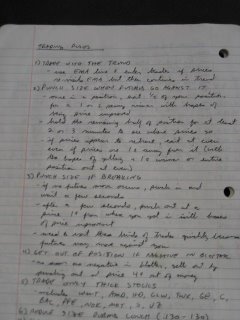

For the first few months of my trading journal's life, I wrote down my trading rules and I made it a habit of reviewing them every month. I would remove and add things to my rules and I would write them down in my trading journal. I now have an electronic version on my word processor at home and I *try* to review it monthly. Here are some of my "Trading Rules" entries from my trading journal

Also of importance were the lessons I learned on my bad days. I put notes at the bottom of my entries, whether it was something I learned, something I needed to avoid, or some kind of behaviour I needed to be aware of.

I recently bought a new notebook that is smaller and more compact that this one and will become my new trading journal.

In the meantime, I wish my trading journal a happy retirement! You've served me well and we've been through a lot together. I only wish I can learn as much from the new trading journal as you have taught me!

Labels: trade journal, trading

9 Comments:

Subtract money/emotions out of the equation of trading and you simply have a crude video game.

Can you play to win?...........I bet you can, but it's not easy.

Nothing worth having is ever easy that's why few people have it.

Knock'em dead in December.

Cheers

By Anonymous, at November 30, 2006 7:09 p.m.

Anonymous, at November 30, 2006 7:09 p.m.

Stockroach,

Thanks for your comments. It has definitely been a real roller coaster ride in terms of profits and in terms of my emotions. I would probably do much better if these two are taken out from my thinking and trading. I'll continue working on these two things and like you said...it ain't gonna be easy, because if it were, everyone would be rich!

I wish you the best of luck and happy trading!

By J.C., at November 30, 2006 9:06 p.m.

J.C., at November 30, 2006 9:06 p.m.

Hi JC,

Loved the pictures of your trading journals. I've been digging my old ones out lately (getting back in after a few years sabbatical) and going through them. You are much more organized than I as mine are various notebooks, post-its and more than a few takeout menus (lol).

Curious as to why you were in mot during that chop @ 945-1045 and why you passed on the breakout at 21.95/96. To me there was a lot of resistance at the point you entered and was more of a price target.

My apologies if it seems like a bit of armchair quarterbacking (although I did trade it today too) I'm just curious as to why you chose that action.

By the way, great blog. I've picked up a lot of useful stuff from it.

Cheers,

Helio

By Anonymous, at November 30, 2006 10:07 p.m.

Anonymous, at November 30, 2006 10:07 p.m.

Helio,

Thanks for your comment. :) I was the same way before too with various notes on sheets of paper all over the place!

As for the trade on MOT, yea, I avoided that chopiness between 945-1045 and that 21.95 area did look like a great long...unfortunately our system was has been going haywire lately and hence I missed a lot of opportunities (our system has been going online/offline for several weeks now in the mornings).

As for the trade I did get into...I saw that MOT had broken it's intraday high ($22.02) and I thought it would go further up and then when I saw some big size appear on the bid on the Level II, it duped me into getting long...

No need for apologies! In fact, I wish more people would do more armchair quarterbacking via comments so that I can get different viewpoints on what made trades good and what made them bad.

The more people that analyze my trades, the more I learn from them, and so the more advice, the better!

Anyways, thanks for the compliments about the blog and I wish you happy trading and a very good December!

By J.C., at November 30, 2006 10:32 p.m.

J.C., at November 30, 2006 10:32 p.m.

Email me at Cody139x@gmail.com if you are interested in selling this journal..

By Anonymous, at December 01, 2006 1:05 p.m.

Anonymous, at December 01, 2006 1:05 p.m.

Anon@1:05PM,

Thanks for your comments and thanks for the offer. For now, I think I'll hold on to it until I can really get my trading act together. This journal will be my reference for the next little while. But thanks for the offer! I'm truly flattered!

By J.C., at December 01, 2006 6:13 p.m.

J.C., at December 01, 2006 6:13 p.m.

I have never kept a trading journal but I do keep statistics. I find it very useful at the end of each trading day to manually enter each trade into my tracking software.

I do this by exporting my raw trades results from my trading software into a spreadsheet, and then sorting the spreadsheet by Symbol and Time. I thus see each trade by symbol and in chronological order (most useful when you trade several times the same stock during the day and you need to separate them.) Some firms software is geared in a way that the work gets done for you and all you have to do is sort your results directly from that software and then you're ready to export or enter your trades into your own stat package.

Once everything has been sorted out, I then enter each trade into my stats software and as I do so I get to quickly remember, separate, and analyze each trade in a way that I could never do during the day.

It is a time consuming process though, and subject to manual entry errors. So this may not be good for people doing hundreds of trades a day, where a fully automated export would be better. But for quickly reviewing each trade in depth and remembering everything you did with the trading day behind you, there is nothing better.

A trading journal is somewhat time-consuming plus you probably enter stuff in into it is colored by how your trading day went and emotionally affected you. Not so with daily trade stats: everything is in them and it’s looking you right in the face. If emotions have been a factor you’ll see it right in there with the rest.

This process tells me everything I need to know. If I had to enter my impressions in a trading journal after going through with the data-entry process described above, I could probably put it in two or three very brief sentences.

Tony

By Anonymous, at December 03, 2006 3:10 p.m.

Anonymous, at December 03, 2006 3:10 p.m.

Tony,

Thanks for your comments and thanks for sharing how you keep track of your trades. I also find it useful to keep stats on the stocks I trade so that if I find I'm having difficulty with a certain stock, I can swap it out for another. My firm can also provide reports such as the time of day I'm most profitable and which stocks have worked out the best for me. I too have pared a lot down (in terms of what I write down) - it's now mostly numbers I need to be aware of and some numbers for the stocks I trade a lot of. I'll only record trades that were good and trades that were bad (instead of writing down every single 1-penny winner or loser) and I find that by limiting how much I write down, the more focused I can be on the markets.

Anyways, I wish you good luck in December and happy trading!

By J.C., at December 03, 2006 5:23 p.m.

J.C., at December 03, 2006 5:23 p.m.

hi tony, your method sounds a little similiar to mine. however, i track my portfolio's performance every month. i include values like cost paid to enter trade, net after trade, commissions, margin requirements, dates etc.

guess its easier for me as i am not a day trader, but instead trade options where i hold for a few days. great post nevertheless.

By Benjamin, at December 13, 2006 11:13 p.m.

Benjamin, at December 13, 2006 11:13 p.m.

Post a Comment

<< Home